According to Reuters, Malaysian Prime Minister Anwar Ibrahim stated on Monday (September 11) that Malaysia will develop a policy to ban the export of rare earth raw materials to prevent the loss of such strategic resources due to unrestricted mining and export. Anwar added that the government will support the development of Malaysia's rare earth industry, and the ban will "ensure maximum returns for the country," but he did not disclose when the proposed ban will take effect. We compile data on Malaysia's rare earth reserves, production, exports, and global share to observe its impact on the global market.

Reserves: In 2022, the global rare earth reserves are approximately 130 million tons, and Malaysia's rare earth reserves are approximately 30000 tons

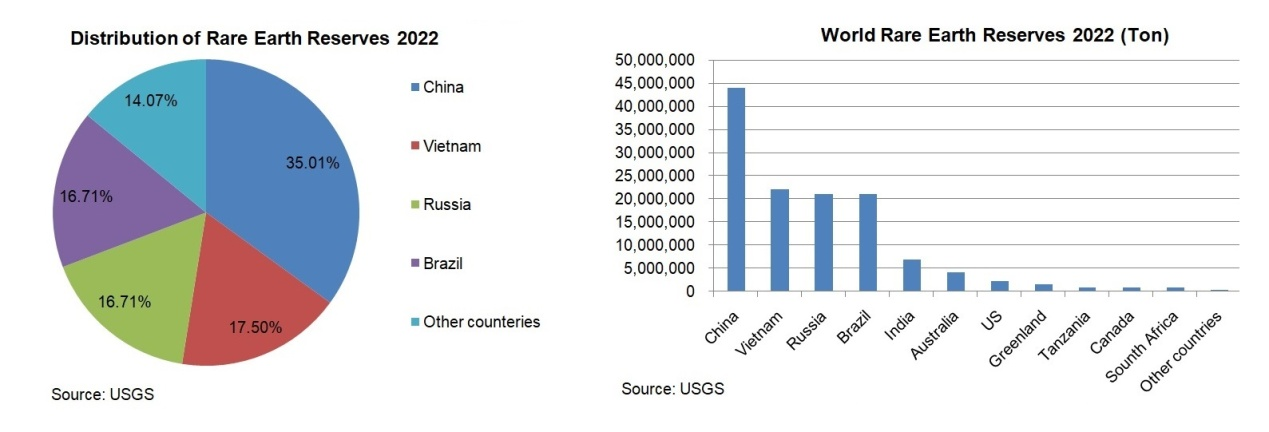

According to data released by the United States Geological Survey (USGS), in terms of global reserves, the total global rare earth resource reserves in 2022 were approximately 130 million tons, China's reserves were 44 million tons (35.01%), Vietnam's reserves were 22 million tons (17.50%), Brazil's reserves were 21 million tons (16.71%), Russia's reserves were 21 million tons (16.71%), and the four countries accounted for a total of 85.93% of global reserves, while the rest accounted for 14.07%. From the reserve table in the above figure, Malaysia's presence is not visible, while the estimated data from USGS in 2019 shows that Malaysia's rare earth reserves are estimated to be 30000 tons, only a small part of global reserves, accounting for approximately 0.02%.

Production: Malaysia accounted for approximately 0.16% of global production in 2018

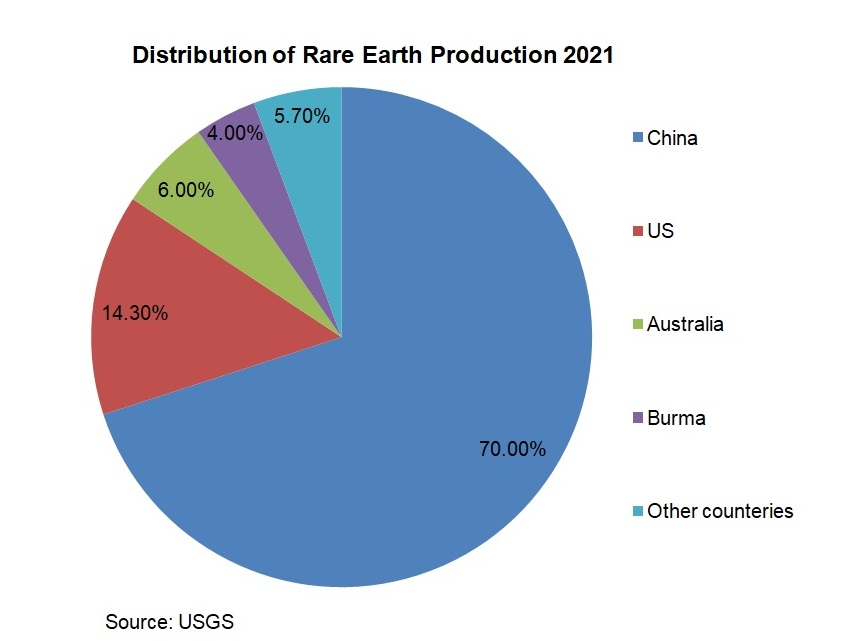

According to data released by USGS, in terms of global production, the global rare earth mineral production in 2022 was 300000 tons, of which China's production was 210000 tons, accounting for 70% of the total global production. Among other countries, in 2022, the United States produced 43000 tons of rare earth (14%), Australia produced 18000 tons (6%), and Myanmar produced 12000 tons (4%). There is still no evidence of Malaysia's presence in the production chart, indicating that its production is also relatively scarce. Given that Malaysia's rare earth production is small and its production data is relatively scarce, according to the 2018 Mining Commodity Summary Report released by USGS, Malaysia's rare earth (REO) production is 300 tons. According to data released at the China ASEAN Rare Earth Industry Development Seminar, global rare earth production in 2018 was approximately 190000 tons, an increase of approximately 56000 tons from 134000 tons in 2017. Malaysia's production of 300 tons in 2018 compared to 190000 tons in 2018, accounting for approximately 0.16%.

According to data statistics, Malaysia exported a total of 22505.12 metric tons of rare earth compounds in 2022, and 17309.44 metric tons of rare earth compounds in 2021. According to import data from the General Administration of Customs of China, the import volume of mixed rare earth carbonate in China was approximately 9631.46 tons in the first seven months of 2023. Among them, approximately 6015.77 tons of mixed rare earth carbonate come from Malaysia, accounting for 62.46% of China's mixed rare earth carbonate imports in the first seven months. This proportion makes Malaysia the largest country in China's mixed rare earth carbonate imports in the first seven months. From the perspective of mixed rare earth carbonate, Malaysia is indeed an important source of mixed rare earth carbonate in China. However, considering the total amount of rare earth metal minerals and unlisted rare earth oxides imported by China, the proportion of this import quantity is still not high. In the first seven months of this year, China imported 105750.4 tons of rare earth products. The proportion of imported 6015.77 tons of mixed rare earth carbonate from Malaysia in the first seven months of this year accounted for approximately 5.69% of China's total rare earth product imports in the first seven months.

Impact: Little impact on global rare earth supply, short-term help boost confidence in the rare earth market

From Malaysia's rare earth reserves, production, and import and export data, it can be seen that its policy of prohibiting the export of rare earths has little impact on China's and global rare earth supply. Considering that Anwar did not mention the implementation time of the ban, after all, there is still some time from the policy proposal to implementation, which has little impact on the market. However, the proportion of rare earth reserves and production in Malaysia is not high, why does it still attract market attention? Project Blue analyst David Merriman stated that the impact of the Malaysian ban is not yet clear due to a lack of details, but the rare earth ban may affect companies operating in other countries in Malaysia. As mentioned by Reuters, Australian rare earth giant Lynas Rare Earth Limited has a factory in Malaysia that processes the rare earth minerals it obtains in Australia. It is currently unclear whether Malaysia's planned export ban will affect Lynas, and Lynas has not responded. In recent years, Malaysia has implemented restrictions on some processing operations of Lynas due to concerns about radiation levels generated by cracking and leaching. Lynas challenged these allegations and stated that they comply with relevant regulations.

The recent closure of customs in Myanmar, rectification of ecological and environmental protection supervision issues in the Longnan region, and the proposed ban on rare earth exports in Malaysia have caused continuous supply disruptions. Although this has not yet had an impact on the actual supply in the market, it has to some extent generated expectations of tight supply, which has stirred market sentiment. Coupled with the impact of downstream industries such as rare earth permanent magnets and servo motors during the peak season, the rare earth market has recently experienced an overall rise. Considering the impact of the above factors, some experts predict that rare earth prices will maintain a strong trend in September unless there is a significant change in supply and demand.

Copyright © Ningbo Horizon Magnetic Technologies Co., Ltd. All Rights Reserved Sitemap